Eliminating negative gearing could shake, but not shatter property market: finder.com.au survey

A majority of economists and experts say abolishing negative gearing would affect housing affordability in the future, according to a recent survey by leading comparison website finder.com.au.

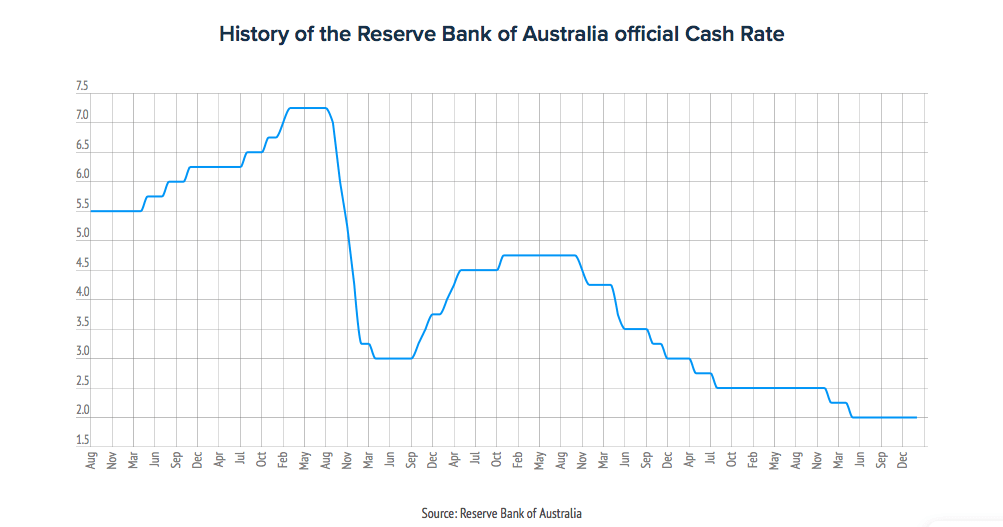

The survey, released in the wake of Reserve Bank of Australia's recent decision to keep cash rates on hold at 2 percent, also revealed that the central bank's decision was expected.

The cash rate has been on pause for almost a year with the last change – a cut – occurring in May 2015.

On the topic of negative gearing, 65 percent of respondents said there was a chance that eliminating negative gearing would result in a drop in property prices, with 23 percent predicting a "significant" drop of over 5 percent.

However, when looking at the effect of removing negative gearing on the market overall, a total of 30 percent thought that this had a some chance or a slight chance of increasing the likelihood of a significant market contraction, or triggering the collapse of a "housing bubble". The remaining 70% of economists said it would not trigger a market contraction. A third (33 percent) said there was no housing bubble in the Australian market.

On the brighter side, a softening of property prices combined with record low interest rates could encourage more first home buyers into the market, according to Bessie Hassan, money expert at finder.com.au.

In addition, the size of Australian mortgages continues to fall, hitting a low of $372,400 in January, dropping from an all-time high of $386,300 in November 2015, indicating uncertainty in the market – which could play out in first home buyers' favour. The average loan size for first time buyers has fallen from $355,500 in October 2015 to $338,800 in January.

"For those first home buyers who have been priced out of the property market to date, now may be their chance to get their foot on the ladder," Hassan said.

"A decline in average national mortgage size shows that borrowers are feeling less comfortable within the low rate environment than they were months ago, and are therefore borrowing less money to buy.

"All borrowers need to remember that these record low interest rate are not here to stay. If and when rates rise, this will lead to higher repayments – approximately $50 per month more for a $300,000 loan size, and thousands of dollars more over the life of your loan.

"Before jumping into the property market, do your research and factor in a buffer of 2-3 percent to accommodate for future rate rises, so you're not stung with a nasty shock months into becoming a homeowner."

The survey, the biggest of its kind, according to finder.com.au, revealed that 34 of 35 leading economists and experts (97 percent) had predicted that RBA would hold rates.

Hassan added that the majority of experts believed the economy was still tracking well and there would be no movement for the rest of the year.

"60 percent (21 experts) forecast the cash rate will hold at 2 percent for the rest of the year, while 20 experts are predicting a rate rise – but not until 2017 at earliest."

Just three experts (9 percent) expect a fall beyond 2016.

Of the economists (31) who weighed in on how low the cash rate would drop this cycle, 52% (16) said it would drop no lower than its current value. Twenty-nine percent (9 experts) predicted a low of 1.75 percent, and 19 percent (6) forecast the rate to drop to 1.50 percent or lower.