How to minimise your risk when investing in property

I am risk adverse and I believe in minimising risk where possible, so I always have a back-up plan for making money and for getting out quickly if I have to.

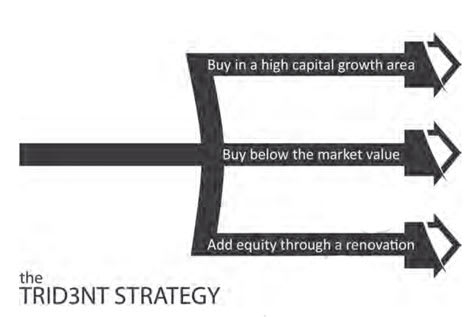

The Trident Strategy is my way of reducing risk to the absolute minimum.

It’s a simple strategy. There are three prongs on the fork. If one of the prongs breaks, there are two other prongs to back you up.

Essentially there are three ways of making money through property investing: make money when you buy; make money in the medium term by renovating; and make money over the long term through capital growth. Hence, if one of my “prongs” is wobbly — for example, I overcapitalise on the renovation, or I pay too much or the area does not grow as expected, I still have two strong prongs that enable me to make money. The skill is in having all three working for you.

In addition to this strategy there are ways you can further reduce your risk, for example:

- Renovate to a point just above the median so you can rent and sell faster.

- Understand what the median property is and who the average tenant is so you know that the property you buy will be in demand, thus minimising vacancies and enabling you to sell quickly if you need to.

What are the risks?

There are many risks associated with a property purchase. Consider the following, which generally apply to any property investment.

Personal risk

This is essentially the risks associated with you: not being able to afford the property, losing your job, and so on. The factors to consider are:

- What is the risk of losing your job?

- What is the risk of the property being vacant for long periods of time?

- How will you cover emergencies? Do you have cash reserves you can access quickly?

Economic risk

This is largely out of your control. It is how the Australian economy is performing, how the world economy is doing and the availability of funds or buyers — and any special one-offs such as the effect of a natural disaster.

Let’s face it, even economists can’t agree on whether interest rates will go up or down, this is hard to predict and control. You need to be aware and consider the risks. With this in mind you might want to start reading reports and listening to the market commentary to become aware of risks.

These risks include tightening of banks’ lending criteria (making it harder for you to get funds), high interest rates, high unemployment and higher costs of living — much of which is discussed in newspapers, on websites and by other media.

Asset risk

Essentially, lenders look at any property investment — be it a home, an investment property or a commercial property — through risk filters. They ask the hard questions that you should be asking; for example, “If this person defaults on the loan, how hard will it be to sell this property?”. Each type of property or security (as lenders consider it) has different types of risks. We can learn from lenders and how they consider risk so that we can apply their methods to our own investment plans.

If your mortgage broker tells you that your lender requires a higher deposit for a particular property it means the lender sees it as a risky purchase and wants you to have more skin in the game — and that should give you a heads up to reassess how risky the purchase is for you as well.

Consider the following scenarios:

- a three-bedroom house within 10 kilometres of the CBD of a capital city

- a one-bedroom, 40-square-metre unit within 10 kilometres of the CBD of a capital city

- a three-bedroom house within two kilometres of the CBD of a small regional town with only one industry (an abattoir that is closing down).

Which is the riskiest? You would have to say the third scenario, followed by the second one and then the first. Why? Because if the lender — or you for that matter — needs to sell your property quickly (for example, if you have defaulted on repayments), the likelihood of being able to do this is much higher under the first scenario than the third one.

Rental risk

What happens if no one wants to live in the property you own? What if they won’t rent it at the price you want? First you need to know what makes a rental property attractive in the area where you want to buy. So, for every 10 properties you inspect in a suburb or town, I encourage you to also inspect at least one rental property in the equivalent price range. This is so you can gauge what the market wants and what the competition looks like, and so you can hear comments from people looking at the rental properties to ascertain what the potential tenants’ or buyers’ needs may be. (Then you’ll have to do the research to confirm this.)

The beauty of the Trident Strategy is that it enables you to optimise capital growth and rental yield.

Not only does renovation as a strategy improve your cashflow, it also reduces your risk by making your property more attractive to tenants and — should the unthinkable happen and you have to sell — more attractive to buyers.

There are further ways to reduce your risk, as we will discuss next. For now, however, you should be not thinking that property investing is a gamble, or that you have to be lucky to make it work. It is about looking at options and taking a low-risk approach to achieving your goals.

Minimising your risk

It’s one thing to know your strategy and another to understand how to assess the risk associated with it. By now you may have a strategy in mind, but know that with every investment comes risk.

There is risk associated with you and risk associated with what you are buying, and in fact your property investing strategy also carries risk. For now, rather than consider how others (that is, the banks) will assess your risk, start thinking about how much risk you are prepared to accept for yourself and your family.

Fundamentally, risk is about the likelihood of something happening and then the consequences of it happening. So if something is highly likely to occur but the result is not so bad, it could be acceptable risk. Conversely, if it is unlikely but the consequence is a disaster, that might be unacceptable risk. You have to understand risk.

Once you have assessed your risk, it’s time to brainstorm the actions, strategies and steps for reducing the risk, and then assess the risk again. You need to ask yourself whether the risk has been reduced. Does the cost of putting the risk minimisation strategies in place outweigh the gain of the investment? For example, if the risk was that the ocean view of the unit you are considering purchasing could be blocked by a new property being developed on the vacant lot in front of it and the only way to keep the view is to buy the block in front, then in most cases the cost of this action would make the purchase not viable — even prohibitive.

As an explosives engineer I used to think about risk in this way for everything I did, so it was not such a stretch to apply the method to my property investing. However, most people will have to condition themselves to think about the likelihood of something going wrong. Ask yourself: what is the consequence and can I live with it? If not, is there something I can do to reduce the risk, or is this a walk-away situation?

This can be anything from big-picture buying (for example, finding the location that fits with your criteria) in a one-industry town to not buying a one-bedroom unit in an area where most people want a two-bedroom unit.

The most important step is understanding how to deal with the high risks and minimising your exposure to such risks.

Devising an emergency exit plan

Before each property purchase — be it your home or an investment property — you need to have a definitive exit strategy. This is one form of risk minimisation. This does seem a little like overkill, but it’s one way that you can greatly reduce your risk and improve your comfort level. For instance, if your strategy is to renovate, you might consider renovating to a standard just above the median value for the area so that you are able to rent the property quickly. This also gives you an emergency exit strategy.

Here’s how.

Consider that something bad (or good) happens and you need cash fast and have to sell the property. If your property is better than others in the market then in theory you should be able to sell it quickly, especially if you are prepared to accept the median price for the property. In other words, you should have a plan B for every decision you make in property investing. This will give you a low-risk property investing strategy.

Location, location, location

There is something you need to consider in order to minimise risk before you buy a property and that’s to buy where people need to live. Essentially, this means buying where there’s going to be long-term population growth, predominantly in capital cities or in growing multi-industry regional towns.

I must stress the ‘”multi-industry” part of this risk-reduction plan. If you buy in a one-industry town and that industry closes down due to economic conditions, natural disasters or the like, you’ll have an asset that no one wants to buy or rent. This is particularly important in relation to mining towns as well as farming centres and even tourist centres. Remember: it is all about plan B and risk reduction.

Say you bought a property in 1980 in Sydney for $80,000 because you got completely emotional and went over the top at the auction and spent almost 10% more than it was worth. After the purchase you may have been worried. But look at the figures 10 years later. Or 20 years later. The secret to the Trident Strategy for low-risk property investing is that the safety net is capital growth. If you do get the renovation from hell and blow the budget, or you overpay, time will help heal all wounds if you buy in the right place.

You will find that, on the whole, when holding property for the long term in capital cities and large regional towns with multi-industries — and not trying to pick the market, the hotspots or doing anything fancy such as buying and selling quickly — prices do increase.

Using rent to mitigate risk

Your property investing strategy is designed to build wealth and to provide an income for you later in life. Sometimes when property values lie stagnant for a number of years, we start to focus on rental yield. After all, it is total return that counts, but during periods where prices are relatively flat, you may look to improving yield returns to give you yield protection.

There are people who argue growth over rental yield. I believe you can have both and you should not have to compromise. The simple fact is you need a healthy rental yield to be able to afford to keep your property portfolio and you need capital growth to grow your portfolio and eventually sell up so that you have money to live off.

Initially, though, many properties will cost you money. Your job when finding a property and property investing strategy is to minimise this cost so you can get to a position where your properties are making you money quickly. You need to know how to calculate rental yield so you can make these assessments.

Rental yield is calculated as follows:

Rent per week: $250

Rent per annum = $250 × 52 = $13 000

Property value: $250 000

Rental yield = rent per annum ÷ property value

= $13 000 ÷ $250 000 × 100 = 5.2%

Visit www.yourpropertysuccessnow.com.au/ypsbookbonus> to see a list of handy calculations and definitions you will need.

Put simply, a combination of good growth and yield is ideal. In other words, your property goes up in value so that when you sell it as part of your exit strategy it is worth more than you bought it for, even after allowing for inflation ($1 now is worth more than $1 in the future). The higher the rental yield, the less you need to contribute week to week to pay for your property.

For example, if interest rates are 7% per annum and your rental yield is 5.2% per annum, you are paying the difference of 1.8 percentage points out of your own pocket (plus all the other holding costs such as rates and insurance).

It is, simply, good money management to have sufficient funds tucked away to cover the difference — plus any extra costs — of your property investment strategy for a few months. You also have to cover the day-to-day costs of your property — these are often called on-costs. Personally, I allow an extra 25 to 30% to cover landlord’s insurance, strata fees, property management fees, council rates, land tax and maintenance. So if the rent per annum is $13,000 and I allow an extra 30%, I would contribute an additional $3,900 per annum ($13,000 × 0.3 = $3,900). This is ultra-conservative, but planning for the worst-case scenario is what a low-risk property investing strategy is about.

Understanding how this works is important. If you can minimise any extra costs you have to pay, and you have a property in a high capital growth area going up by more than 7% per annum, then you have an advantage.

So how do you improve yield? Maybe you can negotiate to buy the property at a cheaper price. For example, if you bought a $250,000 property for $225,000, the rental yield would be 5.8%.

Another way to improve yield is to renovate. This will add value to the property — but you must ensure that the value added is greater than what you spent on renovations — and hence improve the property value so you can ask for a higher rental amount. So, if you buy a property for $250,000 and you spend $15,000 on a cosmetic renovation such as painting, re-carpeting, redoing the kitchen and cleaning up the bathroom, then arguably the value of the property should be at least the initial value of $250,000 plus the value of the renovation, that is, $265,000.

However, let’s assume that you derived extra value and the property is now worth $280,000. This would mean that for the $15,000 you spent you have created an extra $15,000 in value through your clever and strategic renovation decisions and execution. This could also affect your cashflow, as the renovation would be funded by a higher mortgage and you may have slightly higher repayments, but remember that you will have a great boost in rent.

The secret is that people with a renovation strategy try to do both: buy a property at below its true value and create equity by way of a renovation. Then throw in the fact that they have bought in an area with great capital growth and they have won the trifecta: a property going up in value, bought below the true value, with value added to it through renovation. Yes: this is the Trident Strategy at work.

Understanding rental yield enables you to work out what your portfolio needs to be achieving to minimise your out-of-pocket expenses. I rarely get into the argument about positive cash flow versus high growth and negative gearing investing strategies because I support both. My aim is to have my property going up in value and for the difference between my income and expenses to be minimal.

Borrowing with a buffer

For certain investing strategies, borrowing with a buffer may be the only risk-minimisation action you can put in place. Essentially, this means that if all goes wrong, make sure you have either equity or savings that you can use to cover the additional costs so you don’t have to sell the property at a “fire sale” price that’s unacceptable to you.

If you’re using equity from your home to buy an investment property and you need $100 000 to cover your contribution on a $400,000 property (that is, $80,000 deposit plus stamp duty and legal costs of $20,000), you may consider tapping into the equity with a buffer. So, instead of borrowing $100 000, you would borrow $120,000, giving you a $20,000 buffer, in case you lose your job, you can’t rent the property, the development goes over time or budget or the renovation is delayed.

Peace of mind is nice to have in a situation made stressful enough by other circumstances. There are many ways to reduce your risk. Perhaps we have covered a few that you may not have thought of. Importantly, you just have to start considering every decision from the point of view of risk and minimising risk.

Anything can become safe if you know how to control the risks, as I learned from explosives.

Jane Slack-Smith is director of Investors Choice Mortgages and founder of Your Property Success online education teaching investors to find the right property at the right price. Winner of the Your Investment Property 2009 Mortgage Broker of the Year. Jane is a regular property commentator, author and experienced investor. This is an extract from her new book Your Property Success with Renovation, published by John Wiley & Sons.